montgomery al sales tax registration

Sales Tax Application Form. What is the sales tax rate in Montgomery Alabama.

Alabama Sales Tax Guide And Calculator 2022 Taxjar

The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales.

. Report an Issue. 101 South Lawrence St Montgomery AL 36104. This is the total of state and county sales tax rates.

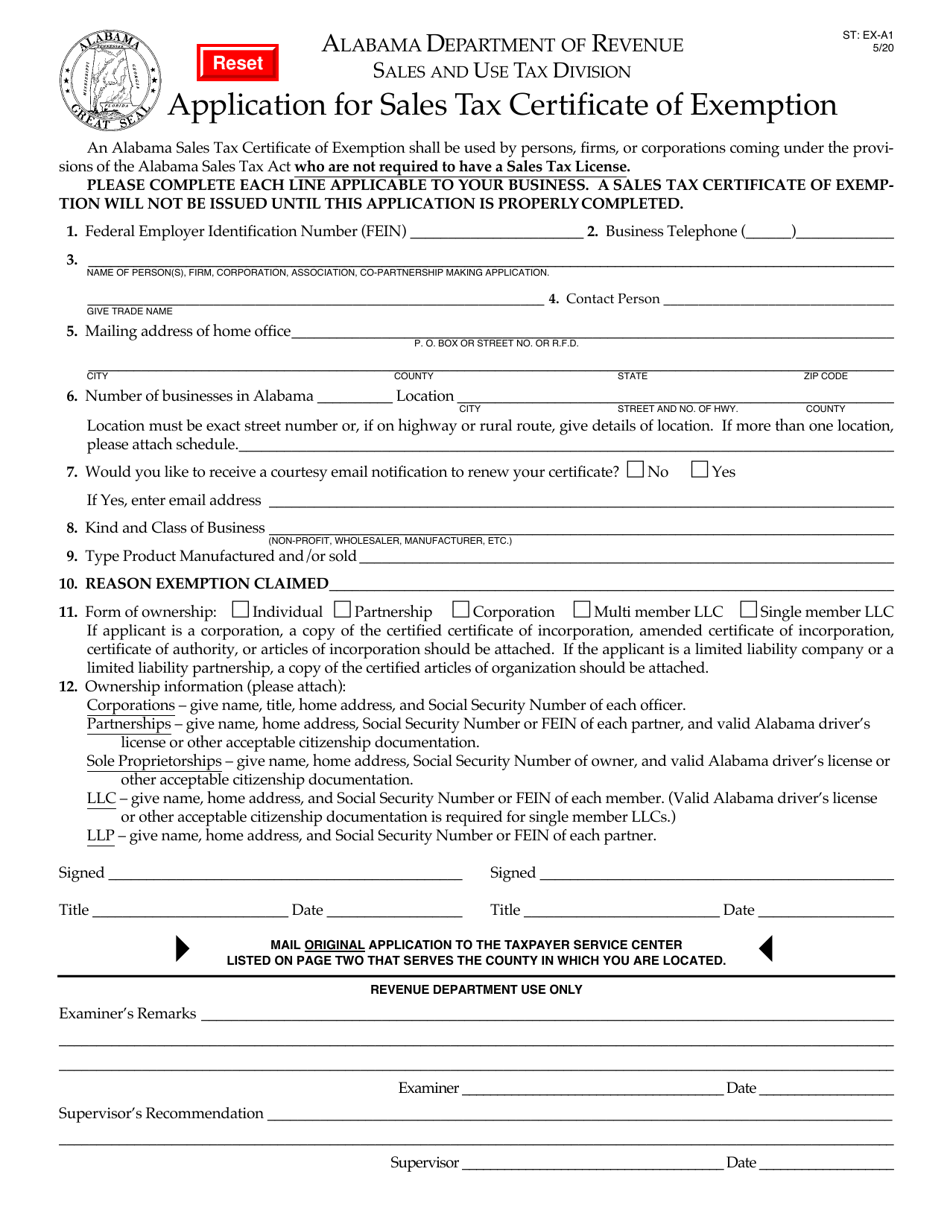

10 of tax. Once you register online it takes 3-5 days to receive an account number. In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business license compliance in Montgomery AL.

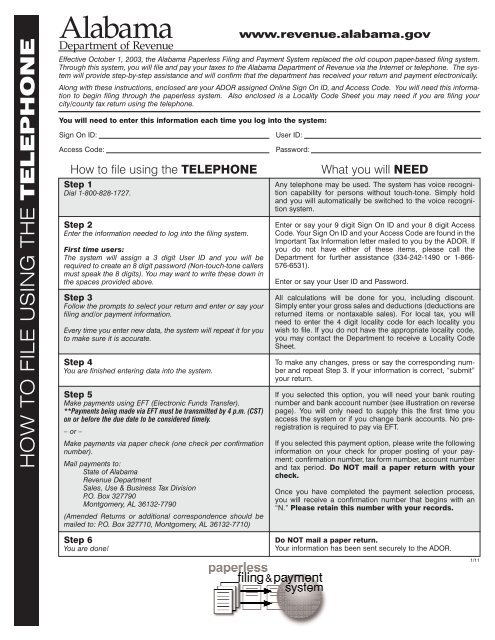

Interest For questions or assistance phone 334 625-2036 3. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types. This is the total of state county and city sales tax rates.

COVID-19 Government Submit A Request. Motor FuelGasolineOther Fuel Tax Form. Alabama Department of Revenue.

The offices are located on the 2nd floor. Montgomery City Sales andor Use Tax. Located outside Alabama that have no inventory for sale in Alabama.

The current total local sales tax rate in Montgomery AL is 10000. The minimum combined 2022 sales tax rate for Montgomery County Alabama is 763. Instructions for Uploading a File.

Montgomery AL 36130 334 242-0400. To report non-filers please email. The minimum combined 2022 sales tax rate for Montgomery Alabama is.

In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return. Request BirthDeath Certificates. Box 1111 Montgomery AL 36101-1111 4.

However However pursuant to Section 40-23-7. Sales Tax WD Fee. City of Montgomery Lodging Tax.

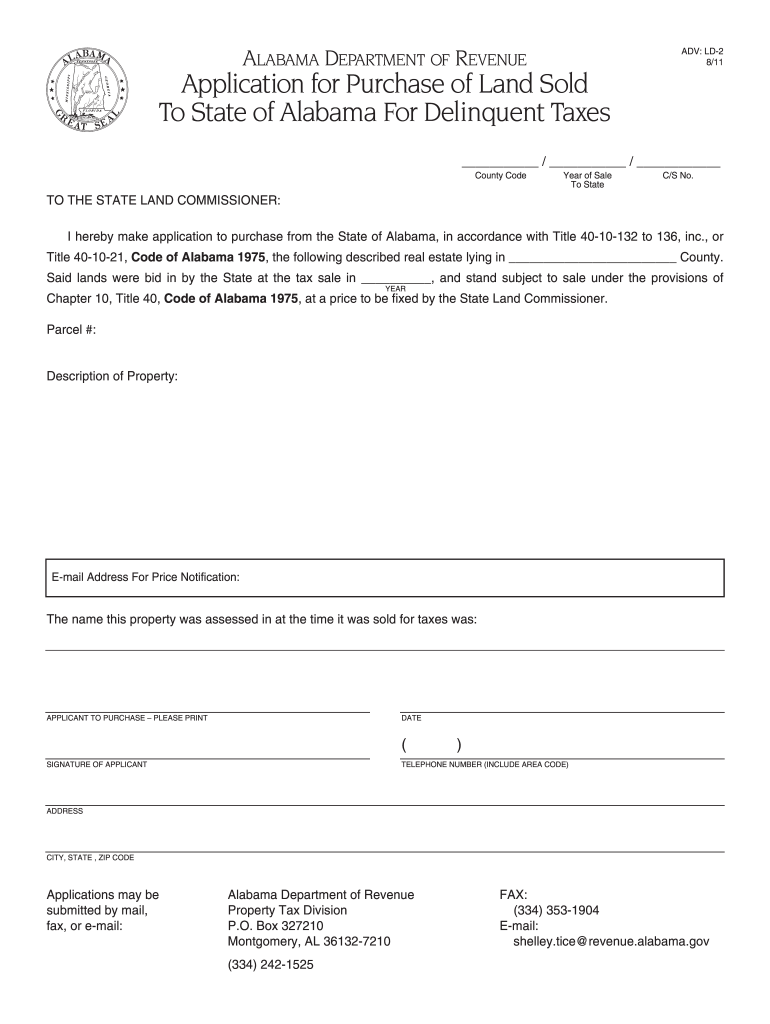

The Tax Audit Department is located in the Montgomery County Courthouse Annex III Building located at 101 S. Sales Use Tax Division. This document may be found here.

Business Registration Unit 334 242-8830. Police Jurisdiction Lodging Tax. City of Montgomery Sales Tax.

Consumer Use Tax Registration. SalesSellers UseConsumers Use Tax Form. Penalty - Late Payment.

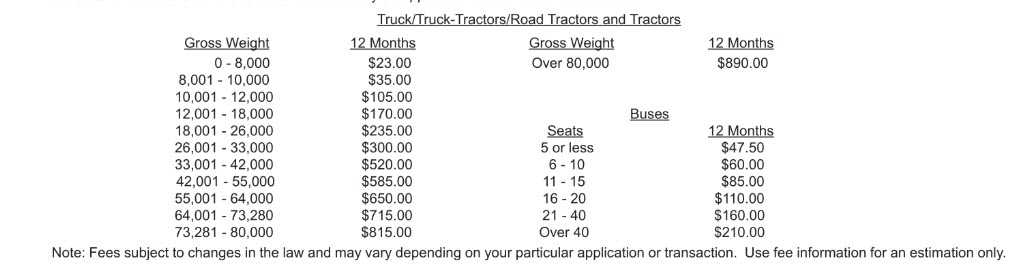

To report a criminal tax violation please call 251 344-4737. Automobile Demonstrator Fee - for. Alabama collects a 2 state sales tax rate on the purchase of vehicles which includes off-road motorcycles and ATVs.

The Alabama state sales tax rate is currently 4. The December 2020 total local sales tax rate was also 10000. Including city and county vehicle sales taxes the total sales tax due.

Sales Tax Alabama Department Of Revenue

Alabama Sales Tax Guide For Businesses

How To Register For A Sales Tax Permit In Alabama Taxvalet

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Maintenance Districts Montgomery County Al

Alabama Tax Title Registration Requirements Process Street

Alabama Set Up Your Online Filing Account Taxjar Support

Adv Ld Fill Out Sign Online Dochub

Alabama Tax Title Registration Requirements Process Street

Alabama Department Of Revenue Montgomery Al

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller

Sahara Restaurant Toofie Joe Deep In Montgomery Alabama Postcard Ebay

Historic Alabama Restaurant Has License Revoked Due To Failure To Pay Sales Taxes Al Com

Alabama Department Of Revenue Alabama Gov

Mgm Film Works City Of Montgomery Al

Sales Tax Alabama Department Of Revenue

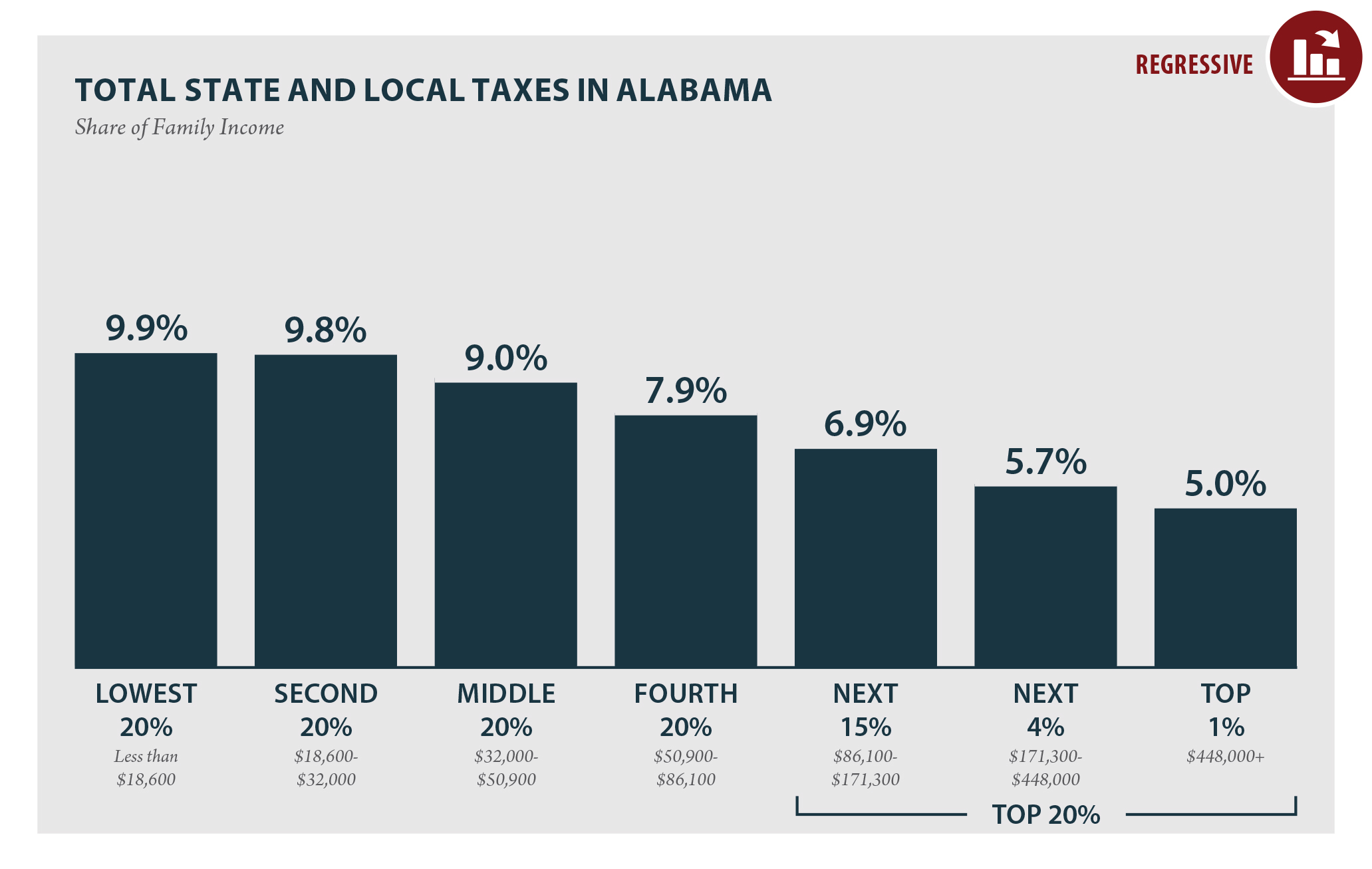

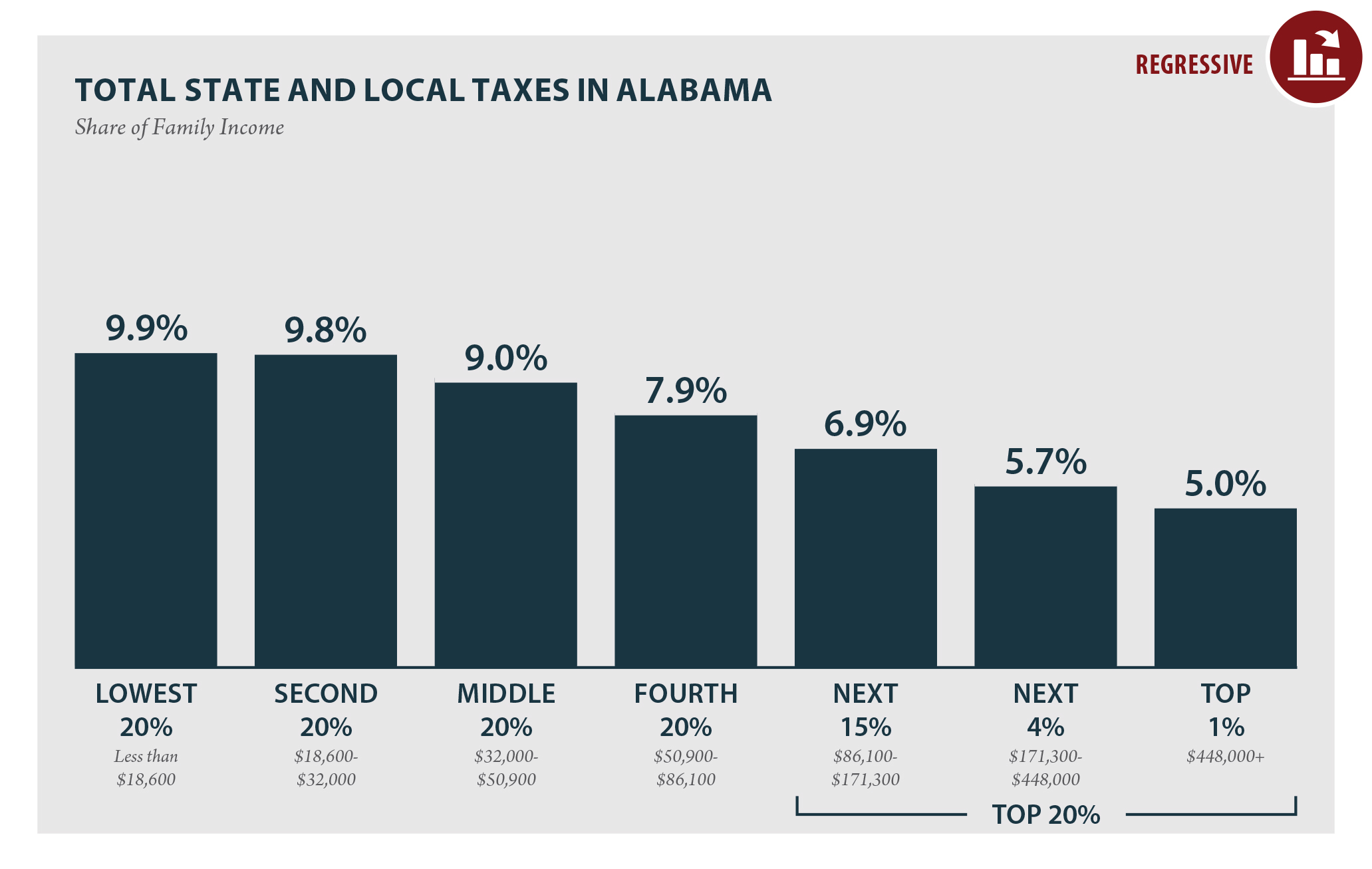

The Less You Make The More You Pay Alabama S Taxes Remain Upside Down Alabama Arise